[ad_1]

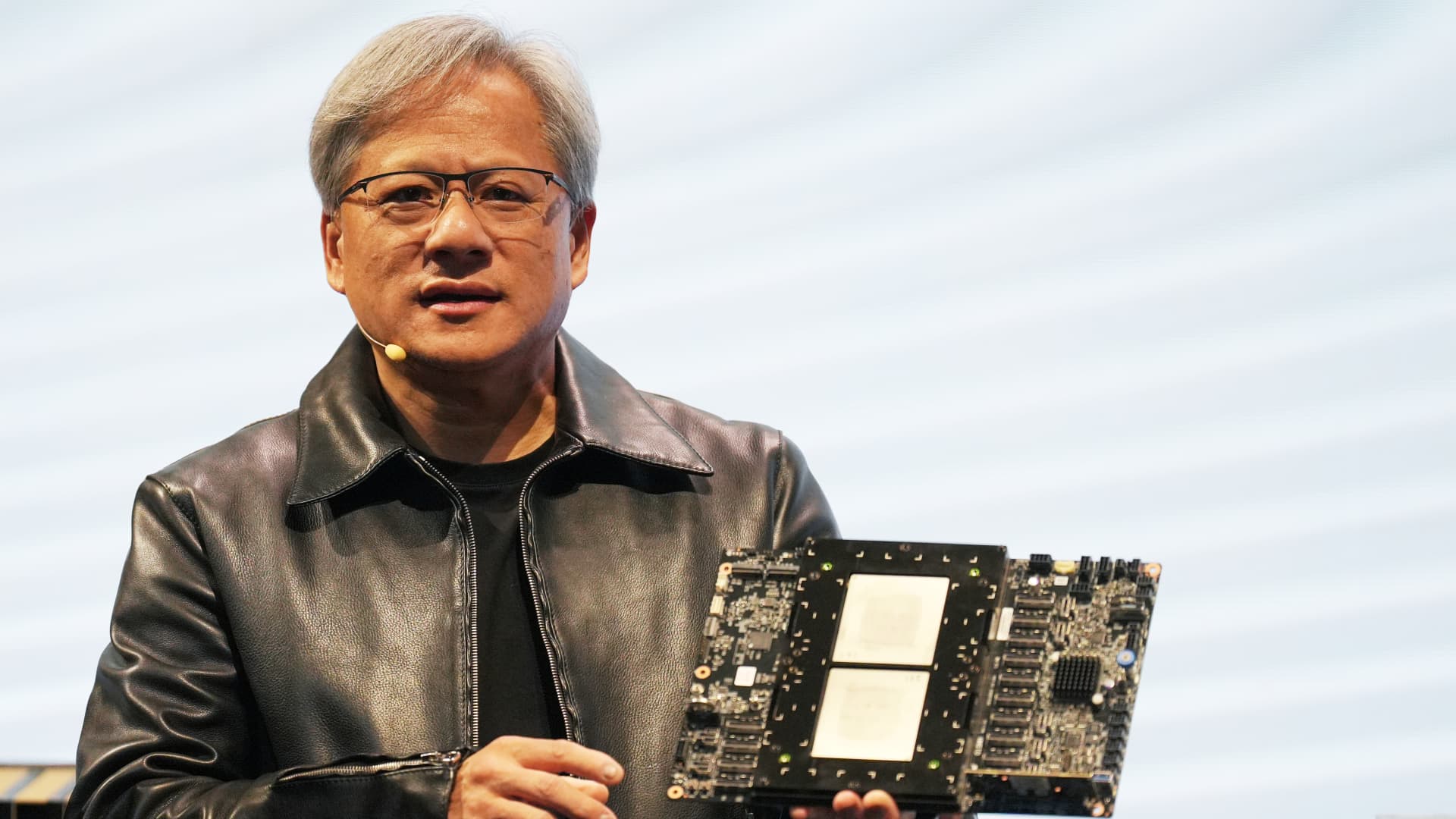

Nvidia President Jensen Huang holds a Grace Hopper Superchip CPU used for generative AI at a Supermicro keynote presentation during Computex 2023.

Walid Berezgh | LightRocket | getty images

NVIDIA Shares rose more than 14% in premarket trade Thursday after the chip giant reported bumper earnings that beat Wall Street estimates.

The US tech giant reported revenue of $22.10 billion in its fiscal fourth quarter, an increase of 265% year-on-year, while net income increased by 769%, as the company sees increased enthusiasm over artificial intelligence. Is getting it.

Nvidia chips are used to train huge AI models such as those developed Microsoft And meta,

Nvidia shows no signs of slowing down. The company estimates that its revenue will reach $24 billion in the current quarter, which is far ahead of estimates.

“Fundamentally, the conditions are excellent for continued growth through 2025 and beyond,” Nvidia CEO Jensen Huang told analysts on Wednesday, adding to the bullish sentiment around the stock.

Nvidia’s data center business, which includes the company’s H100 graphics cards used for AI training, reported sales of $18.4 billion in the fourth quarter, representing a 409% increase year-over-year.

Nvidia’s positive outlook prompted a round of broker upgrades on Thursday. JPMorgan raised its price target on Nvidia stock to $850 from $650, while Bank of America Global Research raised its target to $925 from $800.

Nvidia stock closed at $674.72 on Thursday. Shares were under pressure ahead of the earnings report as traders booked profits and investors were worried that Nvidia might not be able to meet lofty expectations.

But its market-beating data allayed those fears and pulled other global chip stocks higher.