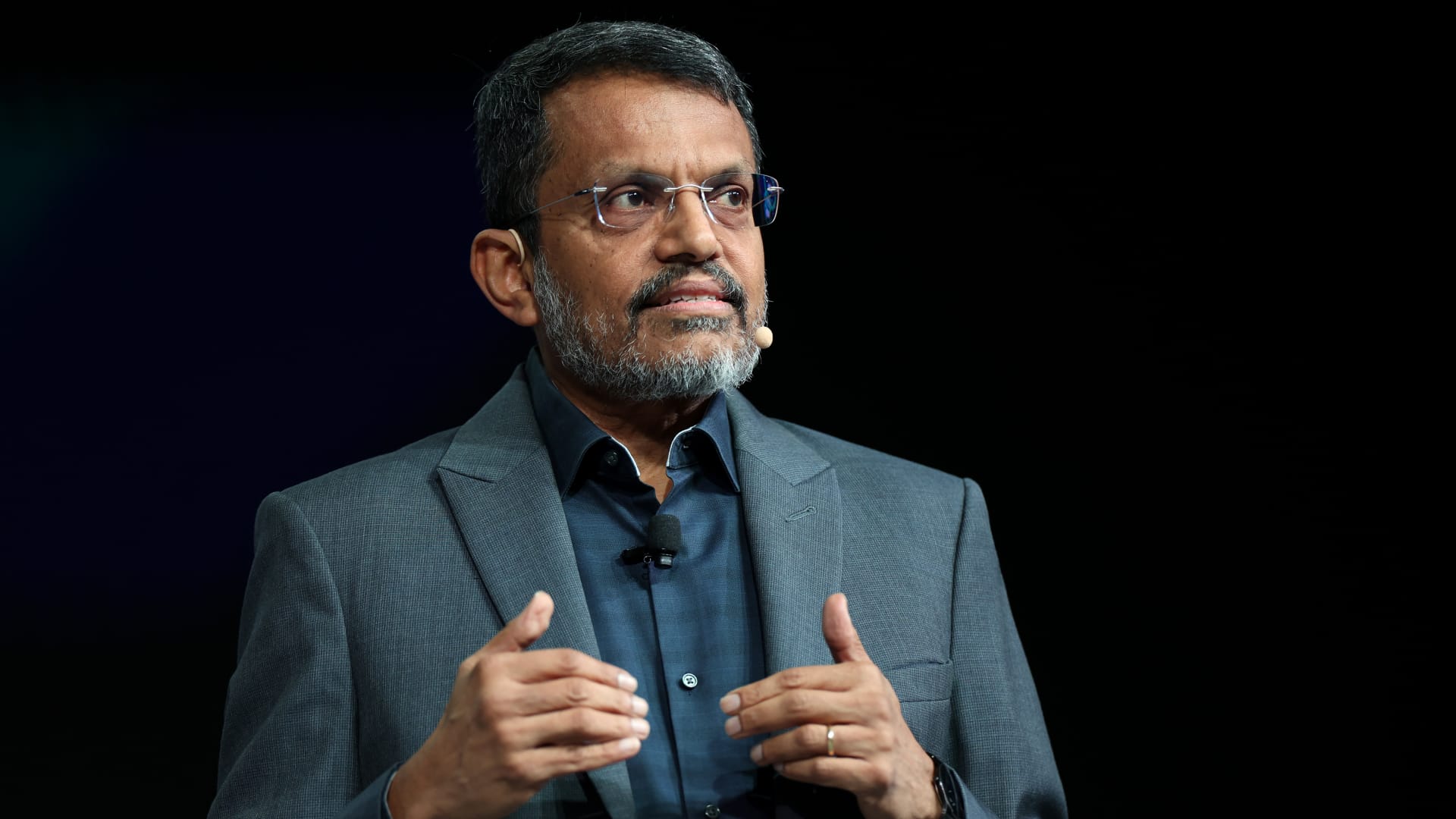

Ravi Menon, managing director of the Monetary Authority of Singapore, speaks during the Singapore Fintech Festival in Singapore on Thursday, Nov. 16, 2023. This festival will continue till 17th November.

Lionel Ng | Bloomberg | getty images

SINGAPORE – In 2024, Singapore will conduct live issuance and use of wholesale central bank digital currencies, Ravi Menon, managing director of the Monetary Authority of Singapore, said.

“We will take our experiments a step further next year,” Menon said at the Singapore Fintech Festival 2023 on Thursday, without giving further details about the timeframe.

“I am pleased to announce that MAS will conduct a live issuance of a wholesale CBDC to immediately support payments in commercial banks here,” Menon said. The MAS is the city-state’s central bank and financial regulator.

Wholesale CBDC is a digital currency issued by a central bank, used exclusively by central banks, commercial banks or other financial institutions to settle large-value interbank transactions. This is in contrast to retail CBDCs that provide services to individuals and businesses, facilitating everyday transactions.

“Since 2016, MAS has partnered with other central banks and the financial industry to explore the use of bulk CBDCs on distributed ledgers to facilitate real-time cross-border payments and settlements,” Menon said, referring to a database spanning a network. Have done many experiments with.” Which is accessible from many geographical locations.

One such pilot project is Project Ubin, which was launched in 2016 to explore the use of blockchain and digital ledger technology for payments and securities clearing and settlement.

Project Ubin was successfully completed in 2021 after five phases of experimentation. Some of the partners included Singapore’s largest bank DBS and sovereign wealth fund Temasek.

MAS announced Ubin+ in November last year to advance cross-border connectivity with wholesale CBDCs through collaboration with international partners.

Menon said that during the pilot, the central bank of Singapore will partner with local banks to test the use of wholesale CBDCs to facilitate domestic payments.

Banks will issue token bank liabilities as claims on their balance sheets. Retail customers can use tokenized bank liabilities in transactions with merchants, who will then deposit these bank liabilities into their respective banks. Tokenization refers to the process of issuing a digital form of an asset on the blockchain.

The CBDC will be automatically transferred to the merchant as payment during the transaction.

“So clearing and settlement happen in a single phase on the same infrastructure, unlike the current system in which clearing and settlement happen on different systems and settlement happens with lag,” Menon said.

On Wednesday, the Managing Director of the International Monetary Fund urged the public sector to continue preparing to deploy CBDCs and related payments platforms in the future.

Kristalina Georgieva said, “We haven’t hit the ground running yet. There’s a lot of room for innovation and a lot of uncertainty over use cases.”

Menon is set to retire from public service on December 31 and step down as managing director of MAS, since being appointed to the post in 2011. He will be succeeded by Chia Der Jeunen, who previously spent 18 years at MAS.