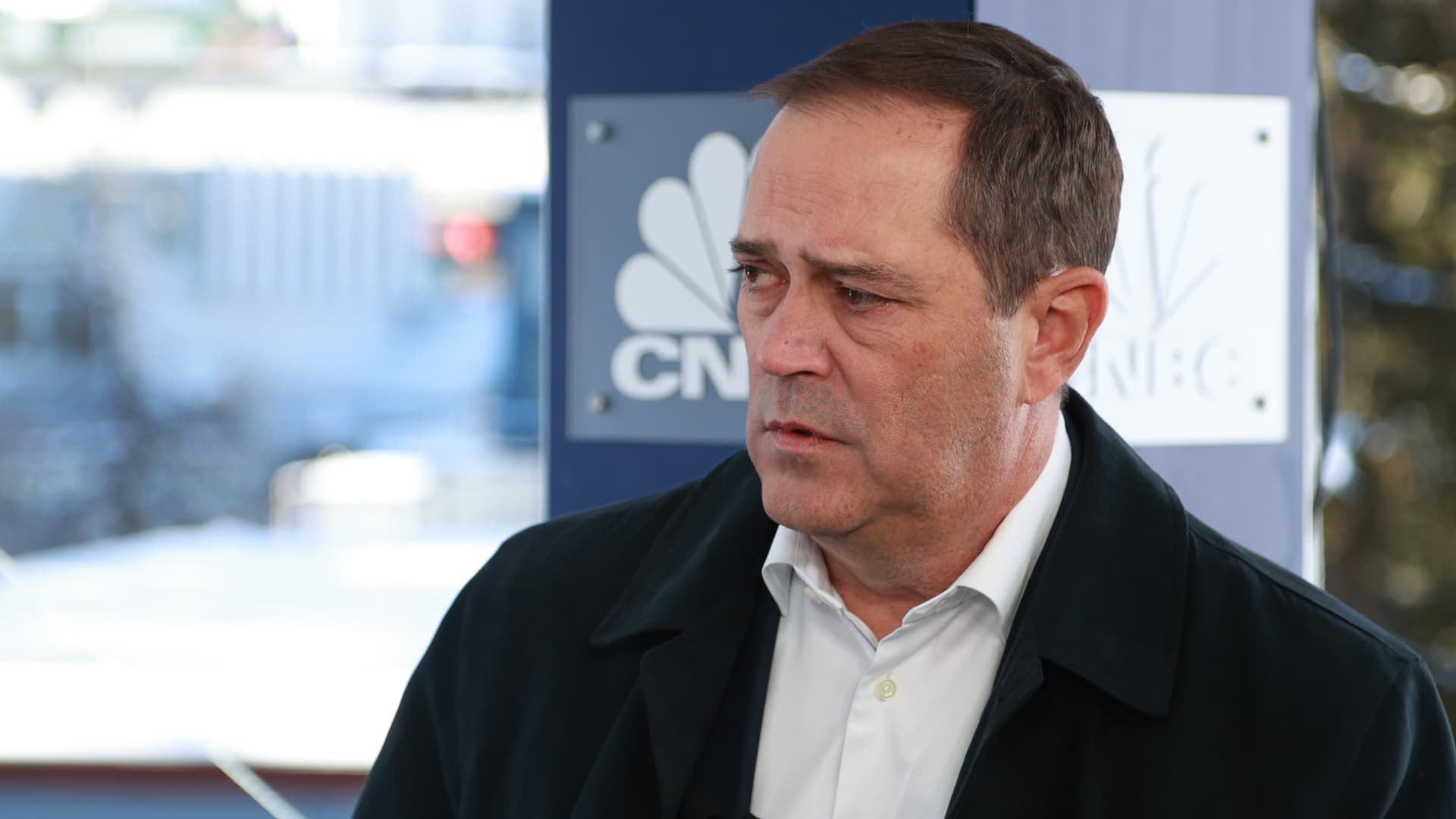

Cisco CEO and Chairman Chuck Robbins speaks on the Squawk Box at WEF in Davos, Switzerland on January 18, 2023.

Adam Galica

cisco Shares fell as much as 13% in extended trading on Wednesday after the networking hardware maker issued disappointing forecasts for the current quarter and full fiscal year.

The company outperformed the consensus among analysts surveyed by LSEG, formerly known as Refinitiv:

- Earning: $1.11 per share, adjusted, vs. $1.03 per share expected

- Income: $14.67 billion vs. $14.61 billion expected

Revenue increased 7.6% in the fiscal first quarter ended October 28, according to a statement. Net income, $3.64 billion, or 89 cents a share, rose from $2.67 billion, or 65 cents a share, in the year-ago quarter.

Cisco said in the statement that during the quarter, new product orders slowed, primarily because customers are busy installing and deploying products following strong deliveries over the past three quarters.

“Our customers and our sales organizations have been very clear with us over the last 90 days that this is the issue,” Cisco CEO Chuck Robbins said on a conference call with analysts. But he said the sales cycle is longer than usual.

The company is estimating that one or two quarters of the products shipped are awaiting implementation.

Regarding guidance, Cisco is seeking 82 cents to 84 cents in adjusted earnings per share on fiscal second-quarter earnings of $12.6 billion to $12.8 billion. This implies a 6.6% revenue decline. Analysts polled by LSEG had expected adjusted earnings per share of 99 cents on $14.19 billion.

Cisco lowered its full-year forecast for revenue but raised its outlook for earnings. The company now sees adjusted earnings per share of $3.87 to $3.93 on revenue of $53.8 billion to $55.0 billion. In August, it was looking for $3.19 to $3.32 in adjusted earnings per share and $57.0 billion to $58.2 billion in revenue. Analysts surveyed by Refinitiv had expected adjusted earnings per share of $4.05 and revenue of $57.76 billion.

During the quarter Cisco announced plans to acquire data analytics software maker splunk For $28 billion.

Robbins said Cisco believes it could win orders worth more than $1 billion for artificial-intelligence infrastructure from cloud providers in the 2025 fiscal year. Cisco has been flexible when working with cloud providers and has been able to regain its footing, he said.

“As you look at the AI infrastructure that is currently being supported primarily, they want to move toward a standard broad-based technology like Ethernet so they can really have multiple sources,” he said. ” NVIDIAMellanox, whose graphics processing units are popular for training and running AI models, sells switches that are based on the InfiniBand networking standard.

Despite the after-hours move, Cisco shares have climbed 12% so far this year, lagging the S&P 500 index, which is up 17% over the same period.

Watch: Cisco’s earnings on deck: Here’s what to look for