This week’s Federal Reserve meeting is poised to mark a crucial juncture in the central bank’s approach to monetary policy, signaling a potential departure from the aggressive stance taken over the past two years to counter runaway inflation.

Despite negligible expectations of an interest rate hike, analysts anticipate a noteworthy shift in the Federal Reserve’s strategy. The Federal Open Market Committee (FOMC) is expected to communicate a move away from continuous rate hikes and provide insights into its future plans. This anticipated adjustment comes after 11 consecutive interest rate hikes.

Bank of America’s U.S. economist, Michael Gapen, suggests that this meeting signifies the conclusion of the hiking cycle, emphasizing the Fed’s recognition of potential economic cooling rather than continued aggressive rate hikes.

Key Expectations:

1. Statement Updates:

- The FOMC is expected to maintain the benchmark overnight lending rate in the range of 5.25%-5.5%.

- Language changes in the committee’s assessment of employment, inflation, housing, and overall economic growth may occur.

- Possible removal of references to “additional policy tightening” with a commitment to address inflation.

2. Dot Plot:

- The dot plot, reflecting individual members’ rate expectations, may hint at a possible future rate cut.

- Market analysts will closely observe changes in projections for the next three years and the longer term.

3. Economic Projections:

- The FOMC will release updated projections for GDP growth, inflation (measured through core PCE), and unemployment.

- Minor revisions may occur, with expectations of a slight upward adjustment to GDP and modest declines in unemployment and core PCE inflation.

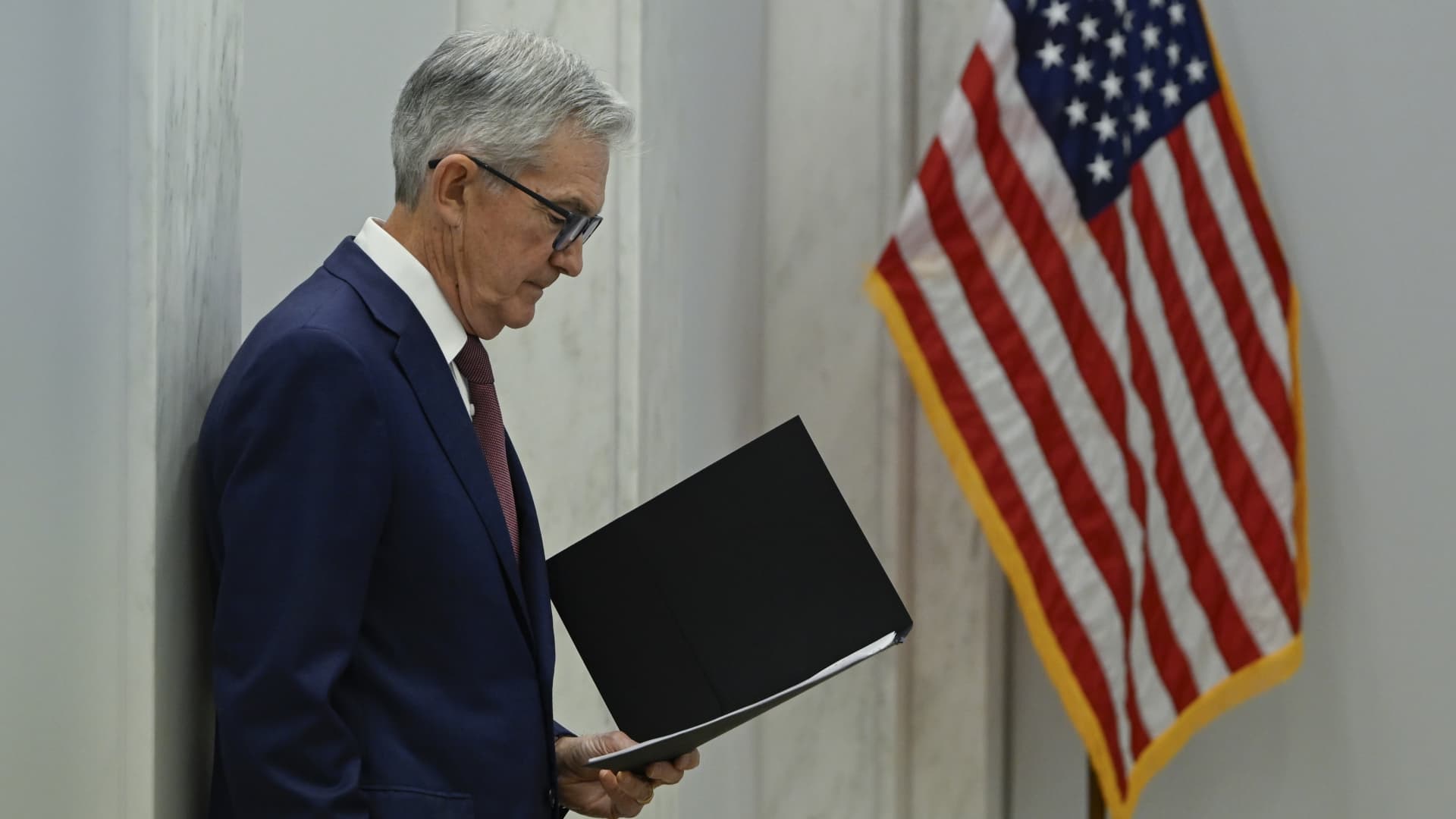

4. Press Conference:

- Fed Chair Jerome Powell’s post-meeting press conference will be closely watched for signals of the Fed’s future stance.

- Powell faces the challenge of balancing inflation-fighting commitments with rising real rates.

Potential Shift in Monetary Policy:

- Analysts suggest that a subtle acknowledgment of a potential future rate cut would represent a significant pivot for the Fed after a series of rate hikes.

- Powell may address ongoing deflation concerns, considering a tapering off in 2024 to maintain real restrictions.

Market Response:

- The market anticipates and responds to potential shifts, with implications for equities.

- Powell’s comments on financial conditions and potential easing may influence market sentiment.

Economic Outlook:

- While market pricing suggests aggressive rate cuts, some economists express caution, pointing to a more realistic timeline for any significant policy changes.

Conclusion:

The upcoming Federal Reserve meeting is expected to provide clarity on the central bank’s shift in monetary policy, addressing inflation concerns while navigating economic uncertainties. Powell’s communication during the press conference will be crucial in shaping market expectations and sentiment.