[ad_1]

Investors may consider putting money to work in the backward part of the market.

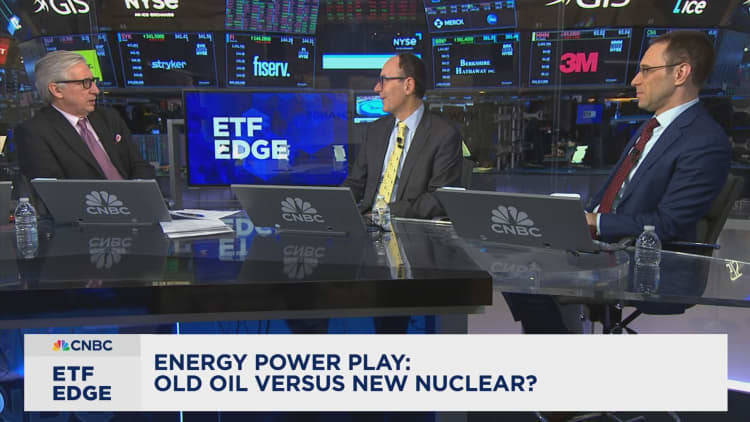

According to VanEck CEO Jan Van Eck, oil stocks are getting a raw deal.

“The [oil] The supply is there. The companies are arguably the next best cash flow companies [compared to] semiconductor,” he told CNBC’s “ETF Edge” this week. “They’re trading at double-digit cash flow yields for E&P. [exploration and production] and areas in the oil market. no one cares. no one cares.”

his firm runs VanEck Oil Services ETF, As of January 31, FactSet shows the ETF’s largest holdings are Schlumberger, halliburton And Baker Hughes,

The ETF is down nearly 7% so far this year, and over the past 52 weeks it is down more than 9% percent. So far this year, S&P 500 There has been an increase of more than 5% so far this year.

“Its [energy] “Many other things are underperforming, but the driver for global growth is actually not bad at the moment and may be so for a few years,” Van Eck said.

Strategus’ Todd Sohn also dislikes oil stocks and sees potential for a turnaround.

“They had quite a large outflow last year. And, if tech hits at some point in the quarter, I think the more strategic guys will move into things like that energy or even Health care” said the firm’s ETF and technical strategist.

wti crude It had its best weekly performance since September – this week it posted most of the year’s gains. The commodity closed up 6% at $76.84 a barrel.